By Ologeh Joseph Chibu

The Nigerian naira saw a significant decline in its value against the US dollar on Monday.

The Naira fell to N1,234 at the official foreign exchange market on Monday, as reported by data from the FMDQ securities exchange.

This sharp drop amounted to a staggering N65 or 5.26 per cent decrease from its previous rate of N1,169.99/$1 recorded just on Friday.

Earlier in the week, there was optimism among traders as the local currency had shown signs of strength, hovering around N1,072.74. Some even speculated that the naira might break the N1,000/$1 barrier for the first time.

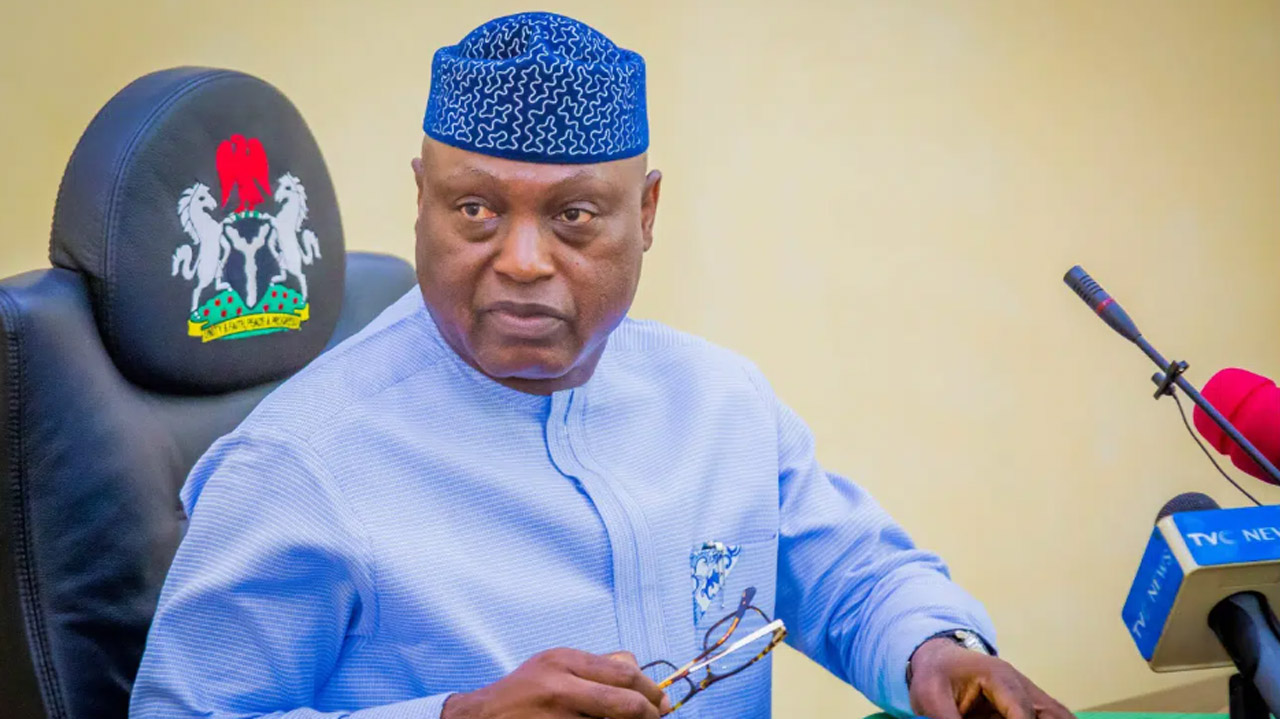

However, this optimism quickly dissipated, coinciding with remarks made by the Governor of the apex bank, Yemi Cardoso, who hinted that the bank’s focus wasn’t on defending the naira, amidst concerns over the sudden drop in external reserves.

Nigeria’s foreign exchange reserves have been on a downward trajectory for a month, reaching a new low of $32.1bn on April 18, 2024, marking a $2.35bn decrease from the previous month.

The CBN governor clarified during the International Monetary Fund/World Bank Spring Meetings that the bank would refrain from intervening in the exchange rate unless unusual circumstances arose, emphasizing that recent shifts in reserves were not aimed at defending the naira.

He emphasized, “I want to make this as clear as possible, it is not in our intention to defend the naira. and as much I have read in the recent few days, some opinions with respect to what is happening with our reserves and if the central bank is defending the naira.”

The naira’s recent struggles in the forex market, exacerbated by the closure of Binance, had seen it plummet to as low as N1,950 in mid-February. While some attributed its earlier woes to alleged market manipulation by Binance, others pointed fingers at the new crypto exchange platforms BYBIT and BITGET for the latest downturn.

Analysts noted a gradual depreciation of the naira over six months from July 2023 to January 2024, particularly evident in the black market following disbursements by the FAAC to government authorities.

Forex transactions revealed a downward trend, with intra-day highs closing at N1,295 per dollar and intra-day lows at N1,051/$. Daily turnover slightly decreased to $110.17m on Monday.

In the parallel market, currency traders sold the dollar at rates ranging from N1,250 to N1,270, compared to N1,154 recorded the previous Friday.

Bureau de Change operators attributed the increase in the dollar rate to market forces, expressing uncertainty about future fluctuations.

The naira’s recent resurgence since late March, which had positioned it as the best-performing currency globally, halted abruptly on Sunday with its first weekly decline in several weeks on the parallel market.

Reflecting on the market’s unpredictability, BDC operator Abubakar Taura commented, “We sold the dollar today between the rate of N1,250 and N1,270, and it is a bit surprising because we don’t even know the real reason, but that is the market, one day there will be profit and another day we make losses.”